Page 37 - Q&A_Digital.indd

P. 37

• The person whose personal information is being transferred

abroad consents to the transfer.

• The transfer is necessary for the performance of a contract

between the person whose personal information is being

transferred and the responsible party.

• The transfer is necessary for the conclusion of a contract

between the responsible party and the third party in the other

country.

Your travel agency, as a responsible party that processes the personal

information of its clients, will be bound to comply with POPI. The most

effective way to ensure that a cross border transfer of personal Commercial

information is POPI compliant, will be to obtain the consent of the relevant

persons whose personal information is being transferred abroad. This will

require that you have POPI compliant consent forms and agreements

which should be signed by your clients. It may not always be possible

to obtain this consent beforehand, and it will therefore be advisable to

seek the help of an attorney to help advise you on how to utilise your

consent forms or other methods to ensure your POPI compliance, should

obtaining consent upfront not be possible.

Capital gains tax paid on monies not

received? What can you do?

May 2017

“I have a few investment properties in my property company.

One such property I purchased in 2002 for R200,000 and

subsequently sold in 2013 for R3,500,000. My company paid

income tax on the capital gain as though I received the full

R3,500,000. However by 2016 I had only received R1,500,000

when the other party fell bankrupt, leaving me without the

full purchase price. SARS refuses to pay back the amount I

overpaid, and I now have a huge capital loss in the company.

Is there anything I can do?”

When your property company sold the property to the potential buyer,

your company became liable, in terms of the Income Tax Act, to pay the

income tax calculated on the gain you made by reason of the sale in

accordance with the following formula:

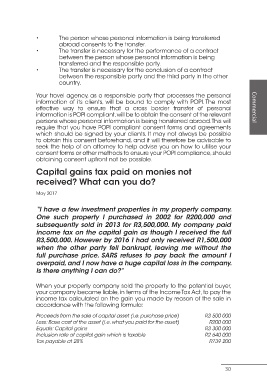

Proceeds from the sale of capital asset (i.e. purchase price) R3 500 000

Less: Base cost of the asset (i.e. what you paid for the asset) R200 000

Equals: Capital gains R3 300 000

Inclusion rate of capital gain which is taxable R2 640 000

Tax payable at 28% R739 200

30